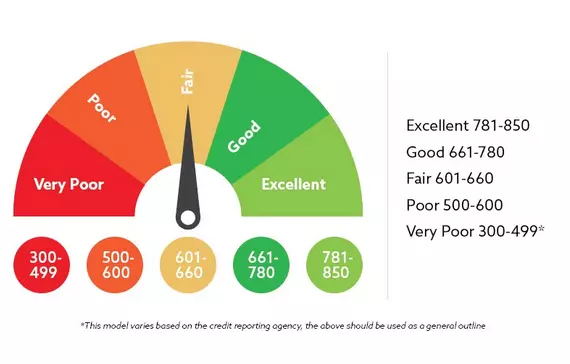

20 Easy Ways to Boost Your Credit Score Before Buying a Home

Creative and Easy Ways to Boost Your Credit Score Before Buying a Home

- Become an Authorized User on a Trusted Account: Ask a family member or friend with a strong credit history to add you as an authorized user on their credit card account.

- Request a Credit Limit Increase: Contact your credit card issuer and ask for a higher credit limit to lower your credit utilization ratio.

- Pay Down Balances Strategically: Focus on credit cards with the highest utilization rates first and aim for below 30% utilization.

- Use Experian Boost: Sign up for Experian Boost to factor in on-time utility and cell phone payments into your credit score.

- Keep Credit Cards Open: Avoid closing credit cards to maintain your average account age and available credit.

- Set Up Automatic Payments: Automate payments to ensure you never miss a due date.

- Pay Off Debt Twice a Month: Make two payments monthly to keep balances low and improve your utilization ratio.

- Dispute Errors on Your Credit Report: Request a free report from AnnualCreditReport.com and dispute inaccuracies with credit bureaus.

- Consolidate High-Interest Debt with a Personal Loan: Reduce your credit card balances by consolidating them into a single, lower-interest loan.

- Open a Secured Credit Card: Build credit with a secured card by making small, manageable purchases and paying them off each month.

- Use the Snowball or Avalanche Method: Pay off small debts first (Snowball) or high-interest debts first (Avalanche) to manage balances effectively.

- Add Rent Payments to Your Credit History: Use services like Rental Kharma or CreditMyRent to report rent payments to credit bureaus.

- Ask for a Goodwill Adjustment: Request a creditor to remove a late payment from your record if you have a good history.

- Avoid New Credit Applications: Minimize hard inquiries on your credit report until after buying your home.

- Diversify Your Credit Mix: Add a small loan or car loan to improve your credit mix responsibly.

- Pay Off Small Balances: Clear small balances on multiple cards to improve your credit report.

- Settle Delinquent Accounts: Negotiate with creditors to settle delinquent accounts and mark them “paid in full.”

- Use a Credit Builder Loan: Build credit with a loan that holds funds in savings until paid in full.

- Keep Your Oldest Account Active: Use your oldest credit card occasionally to maintain its activity.

- Plan Purchases Around Reporting Dates: Pay off balances before the billing cycle closes to report a low balance.

Categories

- All Blogs (75)

- #1 (1)

- 2025 update (6)

- 400 miles of canals (1)

- active lifestyle (13)

- airbnb (2)

- airbnb friendly (1)

- amenities (8)

- andy zemon (1)

- apartment for rent (2)

- appraisal (1)

- arlington park (1)

- artist town (3)

- assessment (1)

- backyard paradise (4)

- bar (1)

- beach condiiton (1)

- beach life (18)

- beach restoration (1)

- beaches (9)

- beachfront resorts (1)

- Benefits (1)

- bike riding (6)

- blog (1)

- blue dog bar and grill (1)

- boating (8)

- Bonita Bay (3)

- bonita beach (3)

- bonita springs (3)

- bradenton (1)

- Brokerage (1)

- builders (3)

- burnt store (2)

- burnt store lakes (2)

- burnt store marina (2)

- business tax (1)

- cafe (2)

- campground (1)

- canal (3)

- canal life (1)

- cape coral (24)

- capecoral (5)

- captiva (1)

- catamaran (1)

- changes (1)

- charlotte county (1)

- charm (2)

- charter school (2)

- checklist (1)

- choosing a forever home (1)

- choosing a location (2)

- close to fort myers (1)

- closing (1)

- coastal life (3)

- community (11)

- community pool (1)

- como lake (1)

- comparative guide (2)

- concerns (4)

- condo for rent (2)

- cons (3)

- cost comparison (1)

- cost of living (1)

- credit score (2)

- custom home (1)

- date night (1)

- developers (2)

- dining (2)

- direct gulf access (3)

- dog friendly (2)

- dog park (2)

- dreams (4)

- education (2)

- endless summer (2)

- esplanade lake club (1)

- estate tax (2)

- exploring (1)

- family (9)

- family friendly (9)

- family operated (1)

- family owned (1)

- family run (1)

- FAQ (1)

- farm life (1)

- favorable (1)

- finances (1)

- financing (1)

- first time home buyer incentives (2)

- first time homebuyer (3)

- fishing (4)

- flood insurance (2)

- flood zone (3)

- florida (41)

- fort myers (12)

- fort myers beach (2)

- freshwater (2)

- fun in the area (3)

- gated community (5)

- get approved (1)

- goals (3)

- golf cart friendly (7)

- growing (4)

- growth (4)

- guide to date night (1)

- guide to schools (2)

- gulf access (2)

- gulf coast (4)

- gulf of america (2)

- gulfside (3)

- hardships (3)

- healthy life (2)

- high cost (2)

- historic (1)

- HOA (7)

- home (1)

- home buying (15)

- home for sale (5)

- home tours (3)

- homeowners (3)

- homes for sale (16)

- homeschool (1)

- homestead (1)

- homestead exemption (4)

- hotel (1)

- hours (1)

- house for rent (1)

- house hunting (4)

- housing market (5)

- how to apply (1)

- hurricane (2)

- hurricane ian (1)

- hurricane season (1)

- hurricane update (2)

- income tax (1)

- indian beach (1)

- informed (1)

- inheritance tax (2)

- inspections (1)

- interest rates (3)

- island life (1)

- island time (1)

- joy (2)

- key west (1)

- key west express (1)

- know before you go (2)

- Know the difference (1)

- lake life (1)

- lake living (1)

- lakewood ranch (4)

- lakewood-ranch-florida-community-guide (1)

- land purchase (1)

- landscaping (1)

- large breed dogs (1)

- large dog (1)

- lee county (9)

- legacy trail (1)

- loan process (1)

- loans (1)

- location (4)

- luxury homes (2)

- magnet schools (1)

- management (1)

- map (1)

- march update (1)

- marco island (2)

- marina (1)

- market update (1)

- matlacha (1)

- mls (1)

- modern homes (3)

- mortgage (3)

- movetoflorida (2)

- moving (16)

- naples (7)

- nature (1)

- nature lovers (1)

- NE Cape Coral (1)

- need to know (7)

- neighborhood (8)

- neighborhoods (4)

- new construction (4)

- no income tax (1)

- nokomis beach (3)

- north jetty park (1)

- novus (1)

- NW Cape Coral (1)

- old florida (1)

- open enrollment (1)

- out of state (1)

- outdoor (1)

- outdoor activities (4)

- outdoor enthusiast (4)

- palmer ranch (1)

- parks (4)

- personal property tax (2)

- pet friendly (3)

- pine island (3)

- places for date night (1)

- places to eat (4)

- places to stay (4)

- plan your trip (4)

- pre approval (1)

- preapproval (1)

- prepared (6)

- private pool (1)

- private school (2)

- property manager (1)

- pros (3)

- public school (2)

- Punta Gorda (4)

- quality of life (2)

- Real Broker (1)

- Realtor (3)

- recovery (1)

- relocating (9)

- relocation (8)

- rental list (2)

- rentals (4)

- Renting (1)

- renting your home from the government (1)

- reopening (1)

- Resort like community (4)

- restaurant (4)

- restrictions (1)

- romantic (1)

- rules (1)

- Rv (1)

- Saint Pete (1)

- saltwater (3)

- Sandoval (1)

- sanibel (2)

- sanibel island (1)

- sarasota (15)

- savings (1)

- school (1)

- school choice (1)

- SE Cape Coral (1)

- seafood (1)

- seasons (1)

- second home (1)

- shark tooth hunting (2)

- shopping (2)

- shops (1)

- short term rentals (1)

- showcase (1)

- siestakey (1)

- small business (1)

- small town island vibes (1)

- smart home (1)

- solar powered town (1)

- south sarasota (1)

- south west cape (1)

- southwest florida (3)

- state income tax (1)

- state park (1)

- step by step guide (1)

- summer (1)

- sunshine (4)

- SW Cape Coral (1)

- SWFL (26)

- Tampa (4)

- tax breaks (2)

- taxes (4)

- theater (1)

- things to do (7)

- to do list (2)

- top 10 (2)

- transferring (1)

- trials (2)

- university town center (1)

- updates (1)

- vacation (2)

- venice (7)

- venice beach (1)

- venice florida (2)

- visit cape coral (1)

- visit sarasota (4)

- visiting (2)

- vrbo (1)

- water utility expansion (1)

- waterfront (2)

- weather (1)

- weekend getaway (1)

- weekly guide (1)

- wellen park (3)

- what to expect (1)

Recent Posts

Top Sarasota Neighborhoods to Live In | Coastal Living Near the Beach

Pool Homes vs. Community Pools: Which Lifestyle Is Right for You?

How to Manage a Florida Property from Out of State | Remote Property Management Tips

Airbnb-Friendly Communities in Southwest Florida (SWFL) + Rental Rules

Is Cape Coral Right for You? Neighborhood Guide to Living in Cape Coral, FL

Best Gated Communities in Naples, FL | Amenities, Beaches & Downtown Guide

Where to Live in Southwest Florida | Compare Tampa, Sarasota, Fort Myers & Naples

Why Moving to Florida’s Gulf Coast Could Change Your Life | From Tampa to Naples

School Choice in Florida 2025: Education Options for Every Family

Wellen Park Venice FL: New Homes, Amenities & Lifestyle Updates (2025)

GET MORE INFORMATION